Site Selection

Advantages

TCEA can help reach your market quickly because we own and manage shovel-ready industrial-zoned property. Additionally, our central location allows businesses can reach over 70% of the USA population in one business day's drive.

Available inventory ranges from 5 to 130 acres – including Tennessee Certified Sites, 4,000-16,000 square foot storage facilities, and several greenfield sites within labor sheds exceeding 1.3million.

All properties are in Foreign Trade Zone 78 and some are also in New Market Tax Credit census tracts, as well as Opportunity Zones.

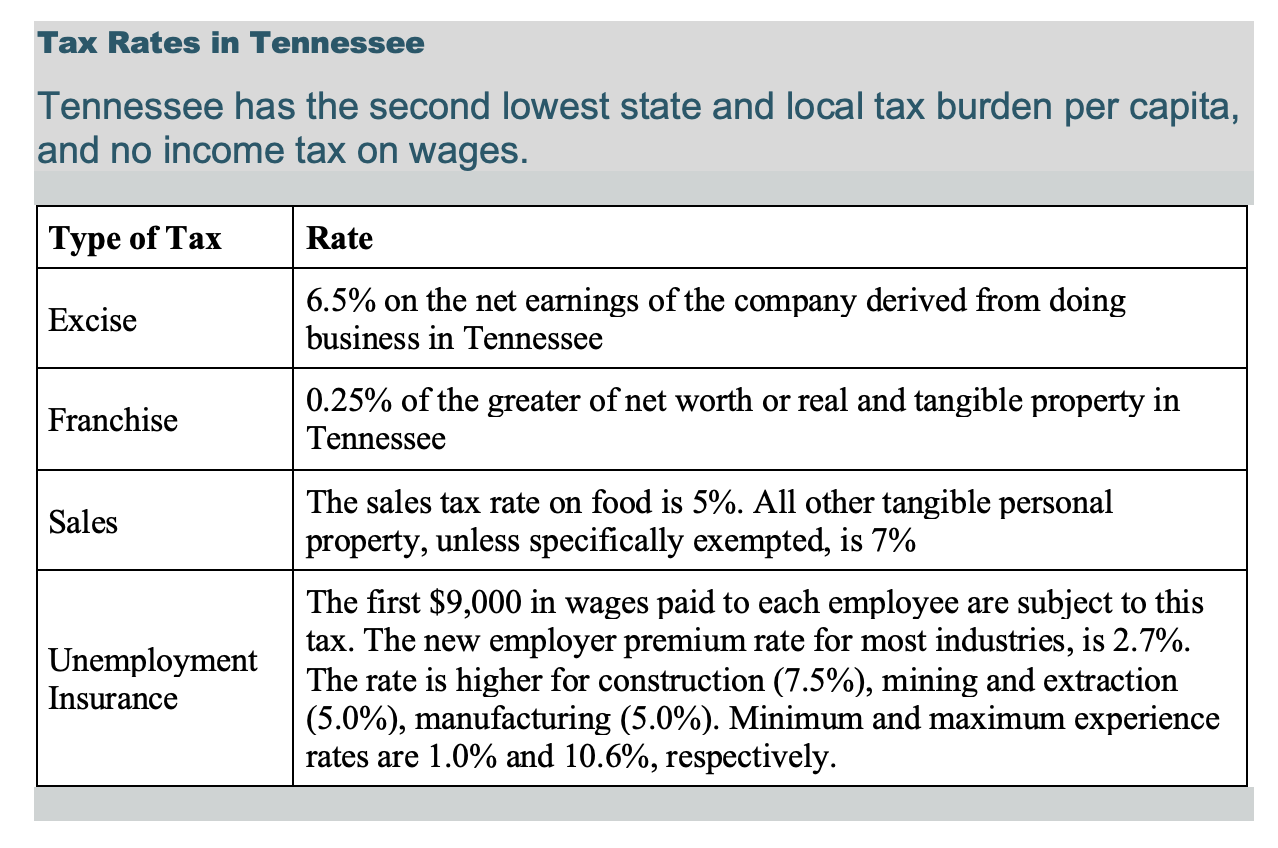

Taxes are low, incentives are strong, resources are abundant, and there is close access to major transportation corridors.

See our Tennessee Valley inventory portal below which highlights the publicly owned inventory and communities we serve. Contact us with your questions.

Taxes and Incentives

Tennessee Department of Economic and Community Development

In Tennessee, experience incentives designed specifically with your business in-mind. Lower operating costs reduce capital outlay and minimize risk. We know what it takes to earn your business. In Tennessee, we're fostering economic growth with flexible tax credits, incentives and grants geared toward your investment. For more information on the competitive state incentives available, click here.

Tennessee Valley Authority Economic Development

The Valley Investment Initiative (VII) is an economic development incentive program jointly offered by TVA and participating distributors of TVA power. VII offers financial incentives to qualifying power customers who contribute to the economic development of the seven-state Tennessee Valley region and complement TVA’s power system resources.

Tennessee Central Economic Authority Regional Grant

This grant is available for counties in the TCEA region (Macon, Smith, Sumner, Trousdale, and Wilson Counties) for economic development. Projects must be endorced by the community's designated joint economic community development entity.

Tennessee Central Economic Authority Grant Guidelines

Foreign Trade Zone 78

TN Central’s region has been designated as part of Foreign Trade Zone Number 78. This designation enables companies locating in those areas to receive equipment, raw materials, inventory and elements that might be added to the manufacturing or distribution process without paying federal duties until the finished product is sold. A duty is a federal tax generally charged on foreign trade items. This status enables foreign companies locating in TN Central Region to take benefit from significant logistical and competitive advantages. Operation of the area trade zone is overseen by the Nashville/Davidson IDB office.

----------------------------------------------

TAXES

TCEA owns POWERCOM and the Industrial Development Board has a pre-approved Payment In Lieu of Tax program with incentives determined by wages, jobs, and capital investment.

TCEA has developed a grant program for industrial projects and POWERCOM is in Foreign Trade Zone 78.

Hartsville/Trousdale is a consolidated government which makes the permitting process an easy one-stop shop with quick turn around times. It is part of the Nashville Metro Statistical Area and boasts a labor shed of 2.3M, and growing!

| POWERCOM INDUSTRIAL CENTER (Hartsville/Trousdale Metro) | CITY RATE | COUNTY RATE (per $100) | ASSESSMENT LEVEL | TAX RATE (per $100 |

|---|---|---|---|---|

| TYPE OF TAX | ||||

| Land | N/A | $2.4388 | 40% | .98 |

| Building | N/A | $2.4388 | 40% | .98 |

| Raw Materials | N/A | $2.4388 | 30% | .73 |

| Machinery (Personal Property) | N/A | $2.4388 | 30% | .73 |

| Equipment (Personal Property) | N/A | $2.4388 | 30% | .73 |

| Source: Tennessee Comptroller of the Treasury Property Assessments |

Macon County and the county seat of Lafayette purchased 130 acres to expand their industrial park. The property is situated in a New Market Tax Credit census tract, Opportunity Zone, and Foreign Trade Zone.

| LAFAYETTE MACON INDUSTRIAL PARK | LAFAYETTE RATE | MACON COUNTY RATE(per $100) | ASSESSMENT LEVEL | TAX RATE (per $100) |

| TYPE OF TAX | ||||

| Land | $.70 | $2.40 | 40% | 1.24 |

| Building | $.70 | $2.40 | 40% | 1.24 |

| Raw Materials | $.70 | $2.40 | 30% | .93 |

| Machinery (Personal Property) | $.70 | $2.40 | 30% | .93 |

| Equipment (Personal Property) | $.70 | $2.40 | 30% | .93 |

| Source: Tennessee Comptroller of the Treasury Property Assessments |

Smith County's newest industrial park is in an Opportunity Zone and their Industrial Development Board offers a P.I.L.O.T. program with a term calculated by jobs, wages, and capital investment.

| SMITH COUNTY INTERSTATE INDUSTRIAL PARK | GORDONSVILLE RATE (per $100) | SMITH COUNTY (per $100) | ASSESSMENT LEVEL | TAX RATE (per $100) | |||

| TYPE OF TAX | |||||||

| Land | $0.7629 | $2.48 | 40% | 1.30 | |||

| Building | $0.7629 | $2.48 | 40% | 1.30 | |||

| Raw Materials | $0.7629 | $2.48 | 30% | .97 | |||

| Machinery (Personal Property) | $0.7629 | $2.48 | 30% | .97 | |||

| Equipment (Personal Property) | $0.7629 | $2.48 | 30% | .97 | |||

| Source: Tennessee Comptroller of the Treasury Property Assessments |

POWERCOM INDUSTRIAL CENTER

TCEA owns POWERCOM and the Industrial Development Board has a pre-approved Payment In Lieu of Tax program with incentives determined by wages, jobs, and capital investment.

TCEA has developed a grant program for industrial projects and POWERCOM is in Foreign Trade Zone 78.

Hartsville/Trousdale is a consolidated government which makes the permitting process an easy one-stop shop with quick turn around times. It is part of the Nashville Metro Statistical Area and boasts a labor shed of 2.3M, and growing!

| POWERCOM INDUSTRIAL CENTER (Hartsville/Trousdale Metro) | CITY RATE | COUNTY RATE (per $100) | ASSESSMENT LEVEL | TAX RATE (per $100 |

|---|---|---|---|---|

| TYPE OF TAX | ||||

| Land | N/A | $2.4388 | 40% | .98 |

| Building | N/A | $2.4388 | 40% | .98 |

| Raw Materials | N/A | $2.4388 | 30% | .73 |

| Machinery (Personal Property) | N/A | $2.4388 | 30% | .73 |

| Equipment (Personal Property) | N/A | $2.4388 | 30% | .73 |

| Source: Tennessee Comptroller of the Treasury Property Assessments |

LAFAYETTE MACON CO INDUSTRIAL PARK

Macon County and the county seat of Lafayette purchased 130 acres to expand their industrial park. The property is situated in a New Market Tax Credit census tract, Opportunity Zone, and Foreign Trade Zone.

| LAFAYETTE MACON INDUSTRIAL PARK | LAFAYETTE RATE | MACON COUNTY RATE(per $100) | ASSESSMENT LEVEL | TAX RATE (per $100) |

| TYPE OF TAX | ||||

| Land | $.70 | $2.40 | 40% | 1.24 |

| Building | $.70 | $2.40 | 40% | 1.24 |

| Raw Materials | $.70 | $2.40 | 30% | .93 |

| Machinery (Personal Property) | $.70 | $2.40 | 30% | .93 |

| Equipment (Personal Property) | $.70 | $2.40 | 30% | .93 |

| Source: Tennessee Comptroller of the Treasury Property Assessments |

SMITH COUNTY INTERSTATE INDUSTRIAL PARK

Smith County's newest industrial park is in an Opportunity Zone and their Industrial Development Board offers a P.I.L.O.T. program with a term calculated by jobs, wages, and capital investment.

| SMITH COUNTY INTERSTATE INDUSTRIAL PARK | GORDONSVILLE RATE (per $100) | SMITH COUNTY (per $100) | ASSESSMENT LEVEL | TAX RATE (per $100) | |||

| TYPE OF TAX | |||||||

| Land | $0.7629 | $2.48 | 40% | 1.30 | |||

| Building | $0.7629 | $2.48 | 40% | 1.30 | |||

| Raw Materials | $0.7629 | $2.48 | 30% | .97 | |||

| Machinery (Personal Property) | $0.7629 | $2.48 | 30% | .97 | |||

| Equipment (Personal Property) | $0.7629 | $2.48 | 30% | .97 | |||

| Source: Tennessee Comptroller of the Treasury Property Assessments |

Testimonials

"Tennessee Central Economic Authority (TCEA) was a big reason our French company landed in Macon County. They connected with our CEO to help find the facility, facilitated tours, hosted meetings, and brought in government stakeholders to help make a deal. After acquiring the building, we continue to work with them. They helped us understand where to live, where to acquire workforce, where to get training resources, as well as determine wage and benefits. I consider them supportive friends."

- Gilles Bidon, Project Director | BABY NOV

"Tennessee Central Economic Authority (TCEA) was a big reason our French company landed in Macon County. They connected with our CEO to help find the facility, facilitated tours, hosted meetings, and brought in government stakeholders to help make a deal. After acquiring the building, we continue to work with them. They helped us understand where to live, where to acquire workforce, where to get training resources, as well as determine wage and benefits. I consider them supportive friends."

- Gilles Bidon, Project Director | BABY NOV

“From day one, TCEA has far exceeded any expectations I had of leasing a commercial building. TCEA has always provided a clean, secure and well maintained industrial park which allows me to proudly and confidently give my customers a tour of our growing facility. TCEA have guided us to resources that provide everything from training incentives to state and federal grant programs to help with both employee recruitment and retainage. TCEA takes the worry away from the property management side of owning my business, which allows me more time to focus on what it takes to be successful in today’s economy.”

- Matt Dockery, President | Tri-Metal, LLC

“From day one, TCEA has far exceeded any expectations I had of leasing a commercial building. TCEA has always provided a clean, secure and well maintained industrial park which allows me to proudly and confidently give my customers a tour of our growing facility. TCEA have guided us to resources that provide everything from training incentives to state and federal grant programs to help with both employee recruitment and retainage. TCEA takes the worry away from the property management side of owning my business, which allows me more time to focus on what it takes to be successful in today’s economy.”

- Matt Dockery, President | Tri-Metal, LLC

"TCEA has been a consistent engaging resource to help Weldon grow. They connected us to workforce resources such as a $30k grant, upskilling and leadership training programs, and regional wages and benefits; all of which resulted in our ability to add another shift"

Peter Chia | Plant Manager | Weldon/Christy's - Hartsville